AI Driven Analytics in Real Estate - 10Pearls

By 10Pearls editorial team

A global team of technologists, strategists, and creatives dedicated to delivering the forefront of innovation. Stay informed with our latest updates and trends in advanced technology, healthcare, fintech, and beyond. Discover insightful perspectives that shape the future of industries worldwide.

How AI-Driven Analytics are Transforming Property Valuation

Blog contents

- AI has evolved property valuation

- Enhanced property valuation accuracy with AI

- Data collection with AI computer vision

- Utilizing AI for market forecasting and predictive analytics

- Leveraging AI to conduct market sentiment analysis

- Benefits of AI-driven property valuation

- Real-world applications of AI in real estate valuation

- AI’s expanding role in real estate

AI has evolved property valuation

The US real estate market is currently valued at approximately $50 trillion with commercial and residential segments driving upward growth. With the rise of AI in real estate, it is anticipated to automate and make property management, valuations, and collecting customer insights more efficient, potentially boosting additional growth of 3-5% in the coming years.

McKinsey estimates by integrating the use of AI in the real estate industry operational costs can be reduced by 15%, which could result in better service delivery and the eventual expansion of the sector as a whole.

Traditionally, property valuation has required appraisers to physically visit properties, manually inspect their conditions, and rely on historical sales data to determine the market values. Although these methods have proved to be effective in their own right, they are often time-consuming and also prone to human errors and biases.

Thankfully, AI is meeting the demand for accurate, fast-paced, and efficient valuation methods. In contrast to human limitations, AI-driven analytics can help process large volumes of unstructured data and give a comprehensive view of a property’s value by integrating market trends, historical data, and environmental risks, employing visual detection, and considering property characteristics.

This has resulted in automated and scalable solutions that not only provide accurate valuations but also keep up with rapid market trends and automate mundane tasks.

Enhanced property valuation accuracy with AI

If you are new to the application of streamlining property appraisals with AI Computer Vision, it is helpful to know that the core impact of AI in property evaluation lies in these three areas: Data collection, data analysis, and data prediction.

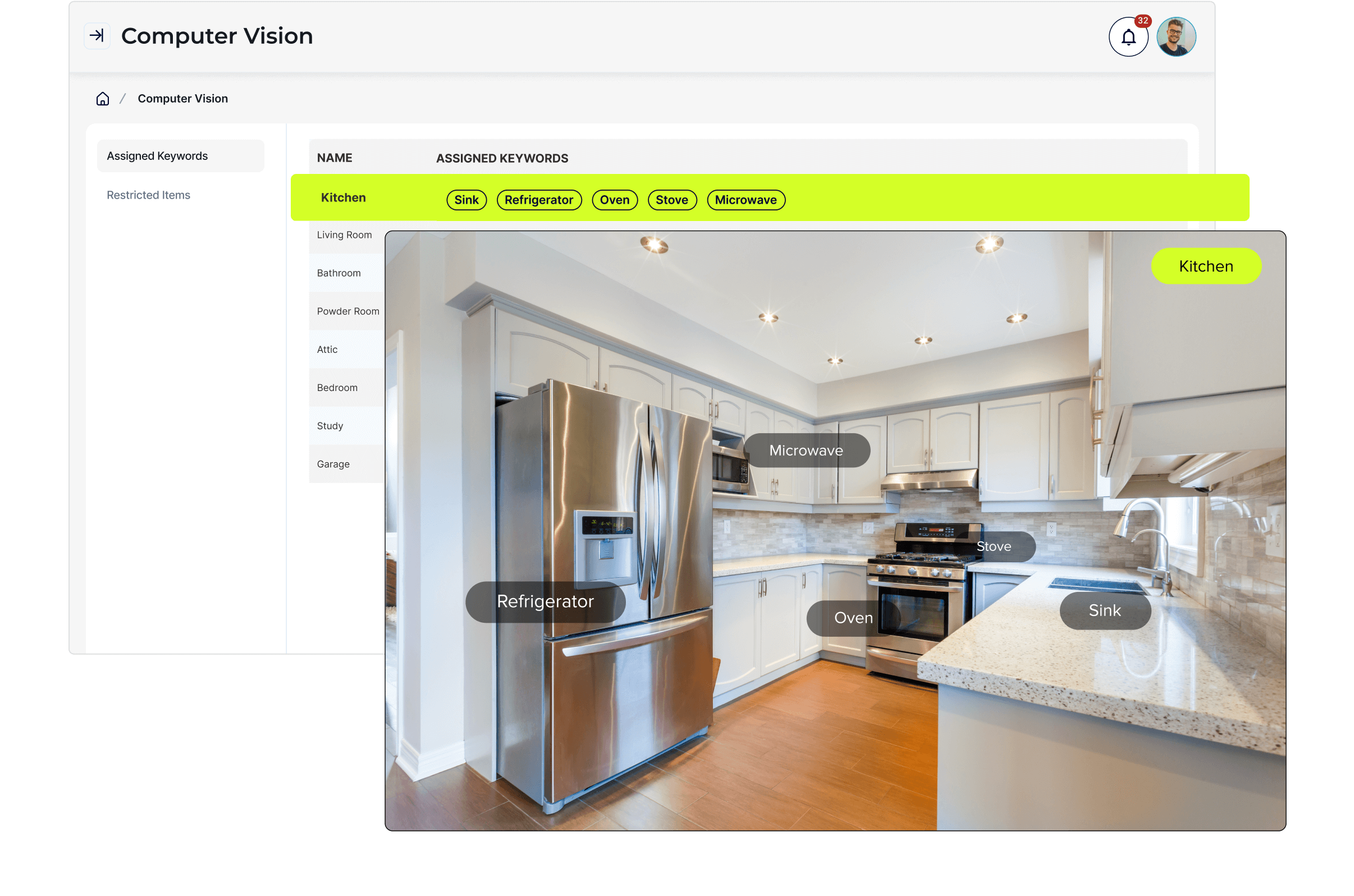

Data collection with AI computer vision

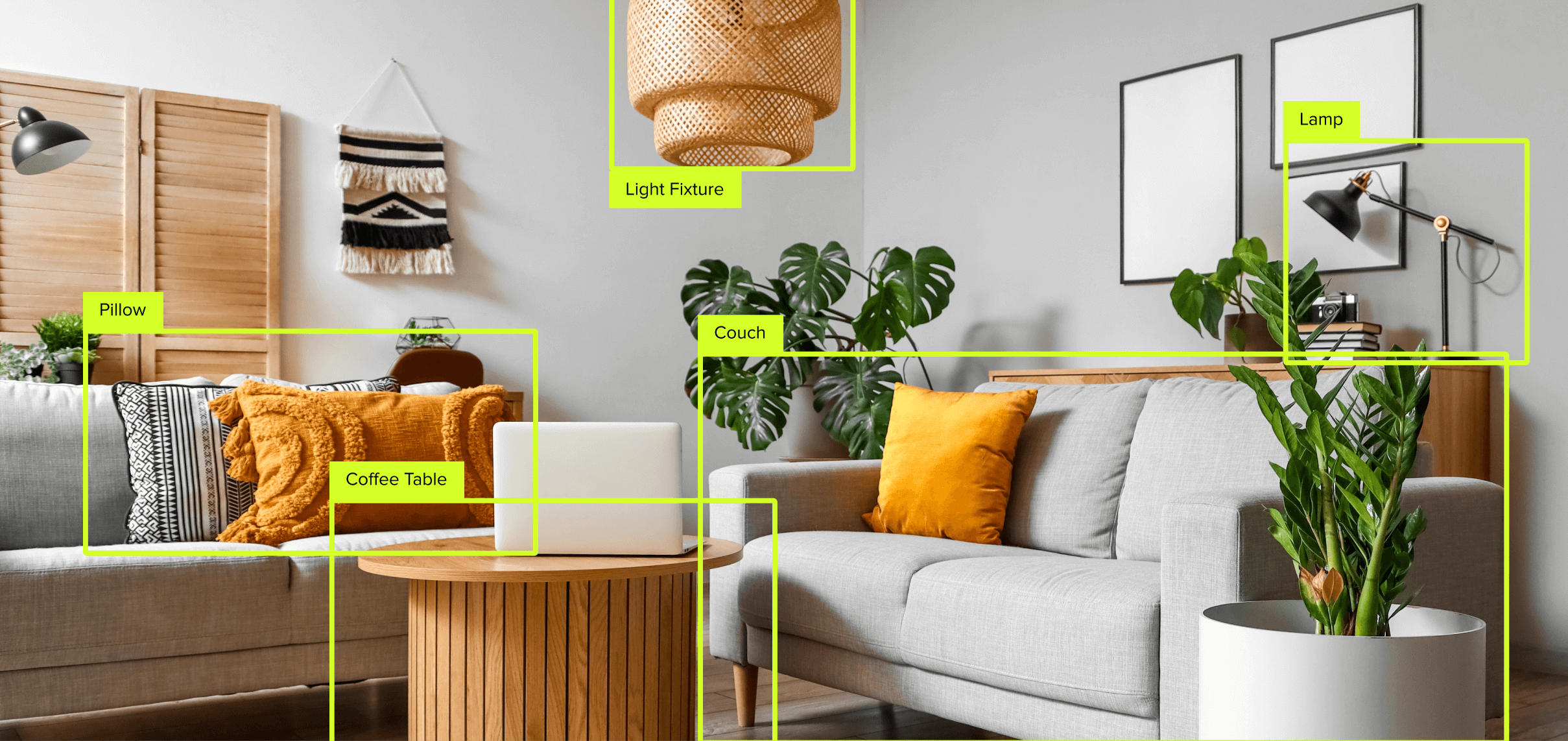

AI computer vision enables machines to collect and interpret visual data, which has been truly transformative for the real estate industry. Computer vision tools can automate the valuation process by simply analyzing images and videos that have been taken on the spot to assess key property features and sometimes even estimate repair costs (if needed).

This technology simply analyses thousands of images to correctly detect any renovations, structural problems, or aesthetic features that might impact a property’s market value. This streamlines manual inspection, making the process more efficient and cost-effective in the long run.

The usage is not limited to the actual construction, it can also be applied via aerial drone footage to provide even further insights into the location, accessibility, and surroundings of a property.

Utilizing AI for market forecasting and predictive analytics

AI automation makes it possible for AI models to accurately predict the projected property values based on historical market data, interest rates, and economic indicators. Predictive analytics can prove to be especially crucial in volatile marketing conditions where sudden changes can impact property values significantly.

A good example of this would be the prediction that certain properties might increase in value if there is an upcoming development in the area, for example, a new metro line. This can help investors make informed decisions, and sellers to time their sales accordingly.

AI predictive analytics can also provide real estate professionals with insights regarding undervalued or overvalued properties.

Leveraging AI to conduct market sentiment analysis

Although market sentiment analysis is qualitative in nature, you would be surprised that it is possible to leverage AI for that as well. AI-powered sentiment analysis tools have the capability to evaluate online discussions, news articles, social media posts, and online reviews among other things, to gauge public opinion on certain neighborhoods or upcoming property development projects.

Positive sentiments regarding school districts, green spaces, transportation hubs, or even tech industry growth can fuel an upward growth in property values. Sentiment analysis helps professionals to stay in line with market trends based on public opinion.

GenAI could generate $110 billion to $180 billion or more in value for the real estate industry.

Benefits of AI-driven property valuation

We have established what AI-drive property valuation can do, let’s look at the benefits it can provide.

Revenue growth

This new technology is driving growth in revenue by providing accurate and data driven property appraisals quickly. Predictive analytics also helps in forecasting future property values, which can help optimize pricing strategies and boost profits. Real estate companies are increasing their revenue growth by up to 20% just by utilizing AI solutions for valuation processes.

AI-driven forecasting engines can automate up to 50% of workforce-management tasks, leading to cost reductions of 10 to 15%

Cost saving

AI property management systems cut down valuation errors by up to 25%, this notably reduces costs, primarily because of improved efficiency and reduction of human error. You can also use AI for early detection of maintenance needs, thereby minimizing expensive repairs and creating additional savings.

Competitive advantage

It goes without saying that adopting AI-powered technology gives companies a competitive edge over those that are still deploying manual methods. By using machine learning and utilizing predictive analytics, firms can now attract clients by providing highly accurate valuations and forecast trends.

This accuracy can strengthen client trust, mitigate risks, and streamline decision making to create a clear market differentiation.

Transparent process

With human errors and biases removed from the picture, AI-driven property valuation is able to provide a very transparent and objective evaluation process. It is consistent and free of bias, ensuring standardization and reliability. This transparency benefits not only sellers but buyers and investors, helping everyone make informed and data-driven decisions.

Quick turn-around time and efficiency

AI-driven property valuation is efficient and takes less time for appraisals. Whereas manual processes can take up to several weeks, especially in complex cases, AI systems have the capability to process large data sets almost immediately.

This enables real estate agents to generate property valuations in real time, which can be very advantageous, especially in competitive markets where time is money in the realest sense.

Enhanced risk assessment

Contrary to popular belief, property valuation is not just limited to determining and predicting value, it also includes assessing potential risks and identifying problem areas. AI models not only analyze property structures but can also generate information regarding crime rates, climate change impacts, and even environmental risks such as flooding in low-lying areas and reoccurring risks of cyclones, etc.

In high-risk areas, the cost of insurance due to factors such as natural disasters and weather damage can significantly alter property values. By considering these factors, AI-driven tools provide a more holistic overview of a property’s true worth.

AI-Driven Property Valuation

Revenue Growth

AI enhances revenue by providing accurate, data- driven appraisals.

Cost Saving

AI reduces costs by minimizing errors and improving efficiency.

Transparent Process

AI ensures objective, unbiased evaluations for all stakeholders.

Quick Turnaround

AI speeds up appraisals, benefiting time-sensitive markets.

Competitive Advantage

AI offers firms a competitive edge through accurate valuations.

Real-world applications of AI in real estate valuation

Despite the technology being new, many companies have started implementing AI solutions in real estate, and 10Pearls is at the forefront of this development; we’ve developed solutions by integrating AI computer vision and predictive analytics to improve both the speed and accuracy of the property evaluation process. This has enabled our clients to automate their inspections, assess potential risks, generate accurate valuation reports, and streamline the process.

AI’s expanding role in real estate

It is safe to say that as AI technology advances with time, its role in real estate will keep growing with new tools and features. AI integration with augmented reality (AR) is still unexplored in real estate.

We may not be too far from a future where appraisers and buyers could walk through a property wearing AR glasses that highlight data in real time.

If you are searching for a technology partner to harness the power of AI in real estate, 10Pearls is here to help. We have deep expertise in computer vision, AI-driven analytics, and predictive insights. Join us and take the next step and give yourself a competitive edge in the market today.

Discover how 10Pearls can help you leverage AI in real estate and unlock new growth possibilities.