Top Industries Driving Software Development in Saudi Arabia

By 10Pearls editorial team

A global team of technologists, strategists, and creatives dedicated to delivering the forefront of innovation. Stay informed with our latest updates and trends in artificial intelligence, advanced technology, healthcare, fintech, and beyond. Discover insightful perspectives that shape the future of industries worldwide.

Driven by its Vision 2030 plan, Saudi Arabia’s software development industry is experiencing rapid growth. With non-oil related industries reaching 50% of the GDP, Saudi Arabia is quickly shifting away from an oil-based economy for the first time in approximately 8 decades. As Saudi Arabia diversifies, the need for adaptable, sector-specific digital solutions is driving a rise in custom and advanced software.

Current state of software development in Saudi Arabia

The local software development industry previously had a small footprint and was focused on the energy and government sectors. This started changing when the government decided to diversify the economy. Vision 2030 and the government’s goals for various sectors accelerated the growth of Saudi Arabia’s software development industry. There has been an increase in the number of new companies and expansion within existing companies to cater to the country’s needs.

There has also been an increase in local developers in the workforce. Nonetheless, the demand far outpaces the local talent available. The need for experienced development and product innovation partners becomes imperative to scale and accelerate the demand, supplementing local talent to meet the digital needs of different sectors.

Top sectors using custom software in Saudi Arabia

Unlike off-the-shelf solutions, custom software can be developed to directly address an industry’s underlying business goals while adhering to specific compliance requirements. Here are the top sectors driving the demand for software development services in Saudi Arabia.

Healthcare

Modernization and privatization are two major catalysts driving growth in demand within the healthcare sector. The privatization goal is to convert 295 out of 499 government hospitals into Public-Private Partnerships (PPP). Private administrations naturally seek more efficiency in hospital operations, often via digital solutions for patient management, inventory optimization, and scheduling, among others. As hospitals transition to PPPs, many will seek experienced software partners to guide their end-to-end digitalization strategies.

Other trends expected to expand software development for healthcare in Saudi Arabia:

- 100% digitization of population-wide medical records. This Vision 2030 goal would ignite the demand for compliant, customized solutions to create and maintain digital medical records.

- $1.5 billion has been allocated for health technologies and teleradiology establishments. Regulatory funding in healthtech can pave the way for dozens of innovative healthcare solutions over the next five years.

- 25 million healthcare insurance beneficiaries by 2030. From benefits tracking to consumer applications, this growth indicates enormous software development potential.

- Growing need for specialized healthcare solutions in the domains of telemedicine, teleradiology, AI/ML-augmented scheduling, preventive care, and diagnostics.

- Regulatory support like Saudi Food and Drug Authority (SFDA)’s medical software licensing initiative can accelerate healthcare innovation in Saudi Arabia. Projects like Seha Virtual Hospital are prime examples of how comprehensive and diverse healthcare software development needs are in the region.

Retail and online payments

Other retail trends influencing the software market in Saudi Arabia are:

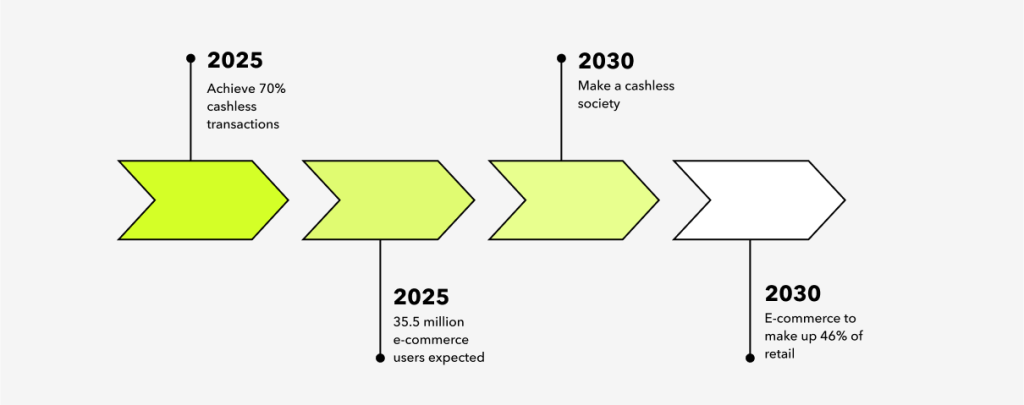

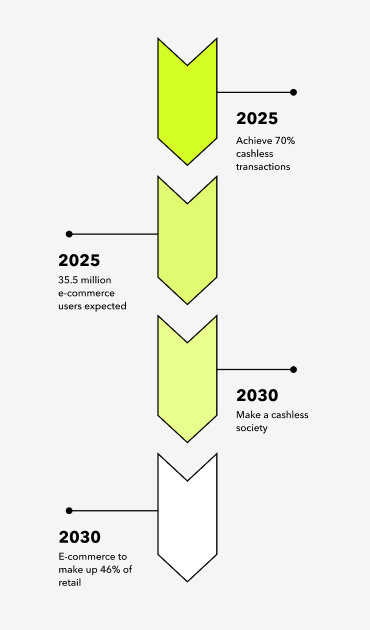

- Goals to have a cashless society by 2030 and achieving 70% cashless transactions by 2025. Saudi Central Bank (SAMA) is the regulatory authority tasked with this goal, and businesses implementing digital payment solutions will need to adhere to SAMA regulations.

- E-commerce is expected to make up 46% of the total retail sector by 2030.This will primarily consist of newcomers and digitized retail businesses.

- The Saudi government expects 35.5 million e-commerce users by 2025.

Retail needs are expected to be incredibly diverse – from enterprise solutions like CRM

and inventory management to UX-oriented, consumer-focused applications. This modernization

in retail will also drive growth in other domains, like cybersecurity.

Manufacturing

Within manufacturing, the goal is to reduce reliance on imports while establishing a strong manufacturing hub in the region. The timeline is fortunate as most Industry 4.0 technologies and practices have matured, and the world is a few years away from Industry 5.0.

Custom software will be a critical component of digital innovations, including industrial intelligence, AI/ML integration, robotic process automation (RPA), and IoT integration.

The main catalysts driving demand for software development in the manufacturing sector are:

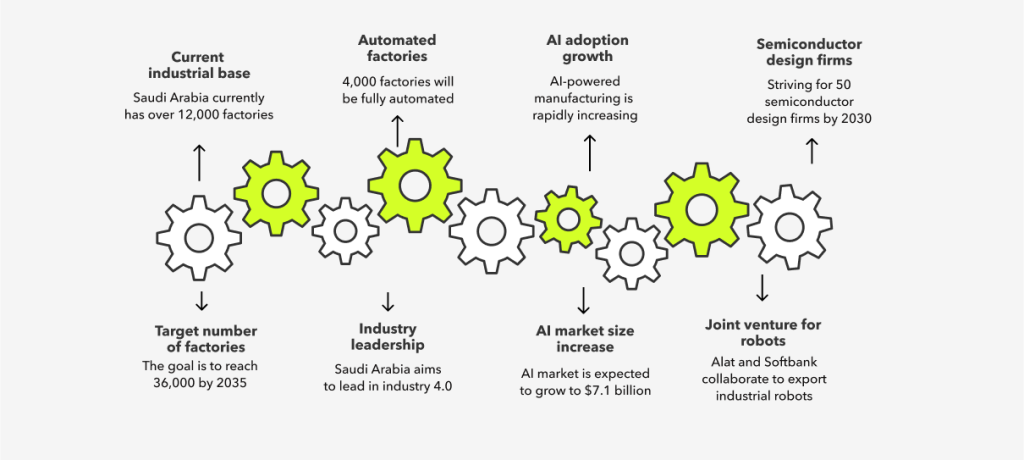

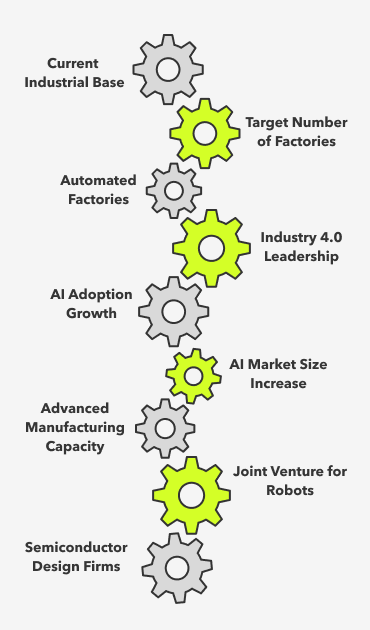

- Achieve 36,000 factories by 2035, with 4,000 being fully automated – current number is just above 12,000.

- Commitment to becoming an industry 4.0 leader in the region and investments in critical technologies like AI and talent development.

- AI adoption in the manufacturing sector is rapidly growing, with the market size expected to grow from $439.8 million in 2024 to $7.1 billion by 2033.

- A sizable segment of manufacturing capacity will be technologically advanced products. Alat and Softbank have a $150 million joint venture to export industrial robots and 50 semiconductor design firms by 2030.

Custom software development demand in other sectors

The demand for custom development is growing in other industries as well, including fintech, education, and tourism.

| Fintech | There is already a fintech strategy in place along with a supportive regulatory environment, which has accelerated the number of fintechs in the region. Saudi Arabia can easily surpass its goal of at least 525 fintechs by 2030 by relying heavily on custom development services for compliant, resilient, and localized solutions. |

| Education | The edtech industry is growing as well with unicorns like Noon, a leading e-learning platform in Saudi Arabia. The government has a multi-faceted education strategy, with initiatives like Irtiqa tracking parent involvement in education and programs like “Future Intelligence Programmer” aiming to train thousands of students in technologies like AI. |

| Tourism | The tourism industry is dominated by Hajj, the annual pilgrimage, which is attended by millions of Muslims from across the world. Apps like Nusuk and Visit Saudi are mature, government-operated digital solutions, but there is ample room for a diverse range of solutions as the tourism industry continues to expand. |

The need for a digital transformation partner

With Vision 2030 well underway, it’s clear that most industries in Saudi Arabia are going through a major transition. This shift has created an urgent need for digital transformation partners with expertise in scalable, future-proof software development.

10Pearls as your custom development partner

As a global digital transformation partner with expertise in various industries and their corresponding regulatory frameworks, our diverse experience enables us to deliver solutions that are both technically resilient and aligned with the specific needs of each sector.

Our AI and machine learning (ML) expertise allows us to develop innovative solutions that scale alongside evolving business needs. From integrating AI models into existing platforms to developing tailored AI-powered systems, we can help organizations in Saudi Arabia leverage advanced AI and ML capabilities like intelligent automation, prediction and decision support, and personalized user experiences to achieve their goals and create measurable business value.

Get in touch with us

Related articles