Problem

In the complex financial landscape that accountants, CFOs, CEOs, and finance professionals navigate daily, the emergence of an AI-driven virtual assistant offers a transformative advantage. 10Pearls partnered with an industry-leading fintech company to develop a solution that would assist professionals with the management of business finances, providing a streamlined approach to extract data from cash flow forecasting, Accounts Receivable, Accounts Payable, and expenses systems to drive insights, analyze trends and variances, query regarding finance cash flows, and optimize financial processes to identify cost reduction opportunities.

Challenge

For financial professionals, extracting actionable insights from a sea of data can be a daunting task. Accountants spend countless hours reconciling accounts and ensuring the accuracy of financial records. CFOs grapple with forecasting and strategic planning, while CEOs require a clear financial picture to make informed decisions.

The traditional approach of financial management often involves a time-consuming process of analyzing and cross-referencing various financial metrics and models. Nonetheless, effectively executing these processes is vital for steering the company's growth and maintaining fiscal health.

Outcome

AI-powered smart assistant

User-friendly chatbot interface

Enhanced financial management

Transformative impact on business finance

Solution

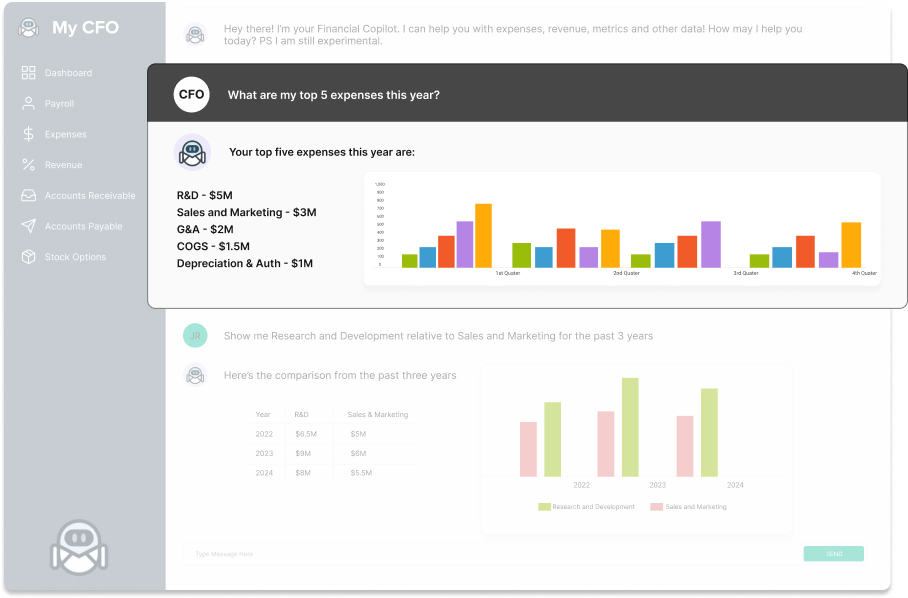

To combat these challenges, 10Pearls developed an AI-powered smart assistant, called MyCFO, to help financial management professionals optimize their financial operations through intelligent responses, insights, recommendations, and task assistance – all based on individualized financial data. My CFO leveraged FinBERT and a combination of GPT-3.5 and GPT-4 Large Language Models (LLMs) to provide users with insights to drive more informed decision making, risk management, and portfolio management.

On the surface, MyCFO presents as a user-friendly chatbot interface designed to address frequent queries and challenges encountered during everyday activities. However, it’s capable of much more. MyCFO serves as a pivotal aid for financial management professionals, enhancing their operational procedures and granting them more active management of their financial affairs, while delivering financial insights and enabling swift retrieval of system-wide information.

MyCFO features a conversational interface powered by a sophisticated Large Language Model. This interface leverages the LLM to tailor responses with specific data rooted in each user's unique financial situation, providing scenario-based answers to user queries in a conversational manner. Whether users have questions about insights, transactions, workflow processes for their Accounts Payable, Accounts Receivable, or Shareholders’ Equity, MyCFO is designed to assist with a natural language approach.

The AI-powered MyCFO marks a significant advancement in business finance management. It offers an unparalleled level of support, transforming complex financial data into straightforward, actionable insights. As businesses embrace this innovative tool, they redefine their financial operations and set a new standard for strategic financial leadership.

THE BENEFITS

ON FINANCIAL

WORKFLOWS The launch of our MyCFO marks a significant milestone for financial management professionals, introducing a new era in task management and execution within the industry.

With Instant Insights, users can now pose questions and receive immediate, insightful answers, effectively conserving valuable time and resources. The inclusion of Transaction-Level Detail functionality enables users to swiftly locate specific transactions or account details, bypassing the tedious process of data search. Streamlined Workflows automate routine financial tasks, ranging from sending reminders to approving transactions, thereby enhancing overall productivity.

Integrating seamlessly into existing financial platforms, MyCFO offers an integrated experience accessible with a simple click from the navigation bar. This ensures a consistent and invaluable presence, providing users with indispensable support and guidance throughout their financial operations.