Staying Ahead of Real-Time Financial

Threats with AI Fraud Detection

By 10Pearls editorial team

A global team of technologists, strategists, and creatives dedicated to delivering the forefront of innovation. Stay informed with our latest updates and trends in artificial intelligence, advanced technology, healthcare, fintech, and beyond. Discover insightful perspectives that shape the future of industries worldwide.

When new transformative technologies emerge in highly regulated industries like finance, they present both opportunity and risk. In the finance sector, AI-driven financial fraud is a prominent example of the negative effects.

In this article, we will discuss key differences between AI-powered fraud detection and traditional fraud prevention strategies, why conventional fraud prevention falls short against AI-driven threats, and how AI can be leveraged to counteract these evolving and real-time threats.

Blog contents

Conventional vs AI-powered fraud detection

All fraud attacks aim to exploit two things: human behavior and defense limitations. In today’s landscape, fraudsters are using a combination of dynamic AI-driven techniques to automate and enhance their methods for identifying and exploiting vulnerabilities.

Conventional fraud detection tools are defined by their static, rule-based architecture, which have proven to be very limiting against the dynamic nature of AI-augmented fraud attacks.

In contrast, AI-powered fraud detection systems leverage deep learning to be more adaptive, allowing them to protect against both known and novel threats in real-time.

How AI is redefining financial fraud detection

Novel fraud identification

Novel fraud identification is a defensive system’s ability to recognize unique or first-time frauds, with no precedent or prior examples. This is something conventional rule-based systems struggle with because setting rules against unknown frauds (without undermining regular operations) is quite challenging.

Novel fraud identification is one of the areas where AI-augmented fraud detection outshines conventional systems. They employ different types of models and techniques to identify any abnormalities and deviations from the norm. These deviations can be tracked until they can be confidently classified as fraud or dismissed as benign. This may include abnormalities in the financial behavior of customers, invoices, transaction requests, etc. This capability also allows AI-based systems to react to frauds and other threats in real time.

Two types of models commonly deployed for novel fraud identification are:

Unsupervised machine learning (UML) models

UML models, like Isolation Forest and Autoencoders look for anomalies in real-time financial data. Not all anomalies are triggered by frauds, and further checks may be required to label them as such, but this creates a layer of protection against unknown frauds.

Each UML model has its own accuracy and precision for different types of frauds, and choosing the right model influences true-positive hits and the number of flagged instances that are highlighted for further research.

Graph neural networks (GNNs)

GNNs analyze a broad range of financial data, such as transaction methods, amounts, locations, etc., to identify the relationships between them. This helps identify common roots for fraudulent activities (locations, phone numbers, bank accounts), and it’s better against large-scale frauds than more targeted attacks. They can also serve as a second layer of defense over UMLs that are better suited to identify individual anomalies and complement them by determining relationships and common factors among anomalies.

Proactive defense

Proactive defense aims to block a fraud attempt, before it evolves into an attack. AI-based tools can proactively flag and stop fraudulent transactions, unauthorized logins, new account frauds, and more, if they detect unusual activity. Both trained and untrained AI models can recognize deviations from normal user behavior. Trained models leverage historical data and look for deviations from known patterns in real-time. While untrained models cluster data points in real-time, isolate outliers, and trigger appropriate defensive actions. AI systems also learn from new fraud activities and their unique characteristics, improving the response time for subsequent attacks with similar patterns.

Adaptability

Machine learning-augmented fraud detection systems are highly adaptable. It allows them to react to changing parameters and attack patterns in real-time. This is helpful when fraud is constantly evolving, and manual updates cannot keep pace.

One great example is Visa’s ARIC Risk Hub, which leverages AI and ML to continuously learn from new data and improve its efficacy. This tech has been proven to reduce false positive alerts by 75%.

Adaptability isn’t limited to threat analysis. ML models also learn from manual interventions, changes in training data, and the success and failure of autonomous decisions triggered after fraud detection. This multi-dimensional, continuous learning allows them to adapt and react even to highly sophisticated and coordinated attacks.

Behavior-based fraud triggers

AI and ML models ingest a wide range of individualized data to generate an understanding of a user’s behavior.

Data types that most models ingest include:

| Geographic | Account type | Demographic | Transaction history | Device information | Authentication data & login attempts |

These datapoints are used to establish baseline behavior, which makes it easy to identify unusual activities through comparison. AI models create tolerance limits based on this baseline. When users deviate from this behavior, alert systems are typically triggered. To avoid generating false positives, they account for event and time-specific triggers, like larger transactions before holidays or several back-to-back transactions during a

market crash.

Risk scoring and network analysis

Risk scoring is one way an AI fraud detection system differentiates between legitimate and fraudulent transactions and interactions. This covers everything from login attempts, password changes, balance checks, and funds transfers. For most systems, risk scores fall within three categories – low, medium, and high – influencing the preventive measure triggered by an action or transaction.

Accurate risk scoring benefits the business in two ways – minimal disruption for legitimate users and fewer potential fraud cases surfaced for further evaluation. The risk is calculated using factors like transaction amount, location, and history. Network analysis informs risk scoring and adds another dimension to fraud detection by evaluating connections like IP addresses and regions.

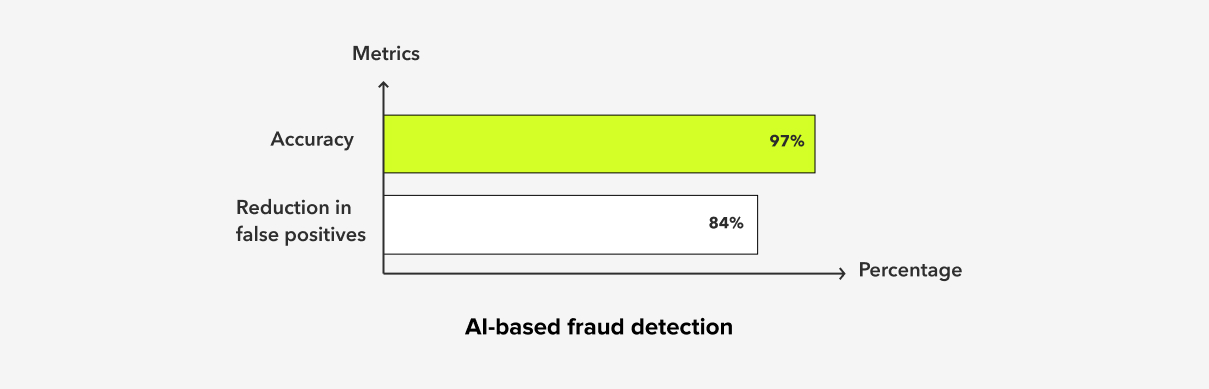

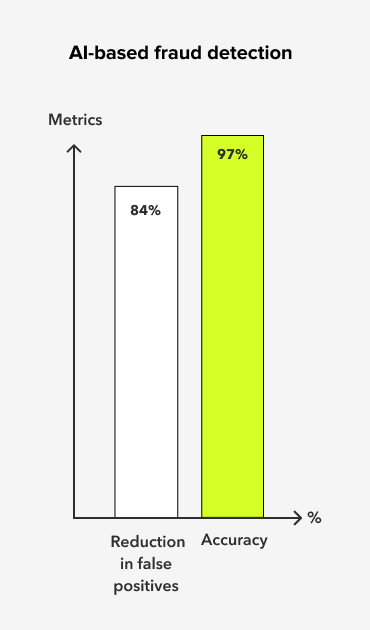

Enhanced accuracy

According to a study, AI-based systems identified suspicious patterns with 97% accuracy and reduced false positives by 84%. This significantly reduces the instances where human intervention is needed, making the process less resource intensive.

AI-based systems also minimize operational friction and customer frustration, as fewer legitimate transactions get flagged and stopped. More importantly, ML models learn and improve over time, so the number of false positives decreases as a function of time, assuming no other enhancements are made to the model.

Scalability

AI fraud detection systems are significantly more scalable compared to traditional rule-based systems since in most cases, they only require more hardware capacity to scale and improve.

The need for human resources and manual intervention is minimal because as they scale and process more data, they become more accurate, precise, and generate fewer false positives. In contrast, rule-based fraud detection requires more human resources as they scale, both to handle the higher number of manual intervention requests and manage the growing rule database.

How 10Pearls helps fintech with AI fraud detection

AI fraud detection is the best and most effective response to the new generation of AI-augmented threats. It’s as dynamic as the attack method, while being adaptable to changing parameters and capable of responding in real-time. But to be effective against the specific threats your business faces, the AI fraud prevention solution must address your vulnerabilities and blend in with your digital infrastructure.

As an AI-powered development company with extensive experience with fintechs, we ensure that we have a comprehensive understanding of your digital infrastructure and business goals, allowing us to integrate AI fraud detection solutions smoothly with your core systems, databases and platforms. From creating an actionable roadmap for your AI solution to deploying an impactful, future-ready solution, 10Pearls can help you every step of the way.

Get in touch with us

Related articles