AI-Driven Data and Analytics in Fintech

By 10Pearls editorial team

A global team of technologists, strategists, and creatives dedicated to delivering the forefront of innovation. Stay informed with our latest updates and trends in advanced technology, healthcare, fintech, and beyond. Discover insightful perspectives that shape the future of industries worldwide.

AI-Driven Data and Analytics are Transforming Financial Services

A profound transformation is underway in the US Financial Services Industry, and breakthroughs in AI technology and data analytics are at the forefront. New technology is reshaping everything from backend operations to customer experience.

This offers institutions the ability to take advantage of vast datasets for fraud detection, analytics, and customization of services. According to McKinsey, financial institutions which are using AI solutions in 2024 could very well see productivity gains of up to 40% because of automation and data driven decision making.

Blog contents

- The impact of AI and data analytics on financial services

- Enhanced risk management and fraud detection

- Creating an AI-driven personalized customer experience

- Leveraging AI for operational efficiency and cost reduction

- AI and data-driven decision-making: A case study of MyCFO

- Benefits of AI in financial services

- The future of AI in financial services

The impact of AI and data analytics on financial services

Although the use of AI is prevalent in many industries, its impact on Financial Services is very significant due to the real-world implications of wealth management and risk analysis. Let’s analyze how AI and data analytical tools are improving upon all aspects related to the field.

Enhanced risk management and fraud detection

While traditional risk management relies heavily on historical data and can be quite limiting, AI allows institutions to access and analyze real-time data, evaluate trends, and create predictive models accordingly. By leveraging this technology, financial institutions can enhance the risk assessment and fraud detection process tenfold.

The Federal Reserve has reportedly reduced fraudulent transactions by nearly 25% across several major banks in the US in 2024 alone; this has been largely due to advanced machine learning algorithms.

Creating an AI-driven personalized customer experience

In the world of business, catering to customer preferences and needs is key to survival. Financial Institutions are leveraging AI-Driven personalized customer experiences. AI engines analyze customer data touch-points to suggest complementary products such as savings plans, investment opportunities, loan options, and even insurance plans based on an individual’s financial appetite and goals.

Deloitte reported that over 72% of US banking customers prefer personalized services over generic offers. This signals a clear demand for these AI and Data Analytics driven approaches to tailored offerings.

Leveraging AI for operational efficiency and cost reduction

AI-powered automation greatly increases operation efficiency and reduces the time taken for routine and mundane tasks that are a part of financial operations, such as compliance checks and document processing.

By implementing AI solutions, institutions can allocate their resources to more strategic roles and reduce operational costs. JPMorgan Chase’s AI-powered contract review system processes thousands of contracts in just a couple of hours, a task that used to take several weeks to do manually.

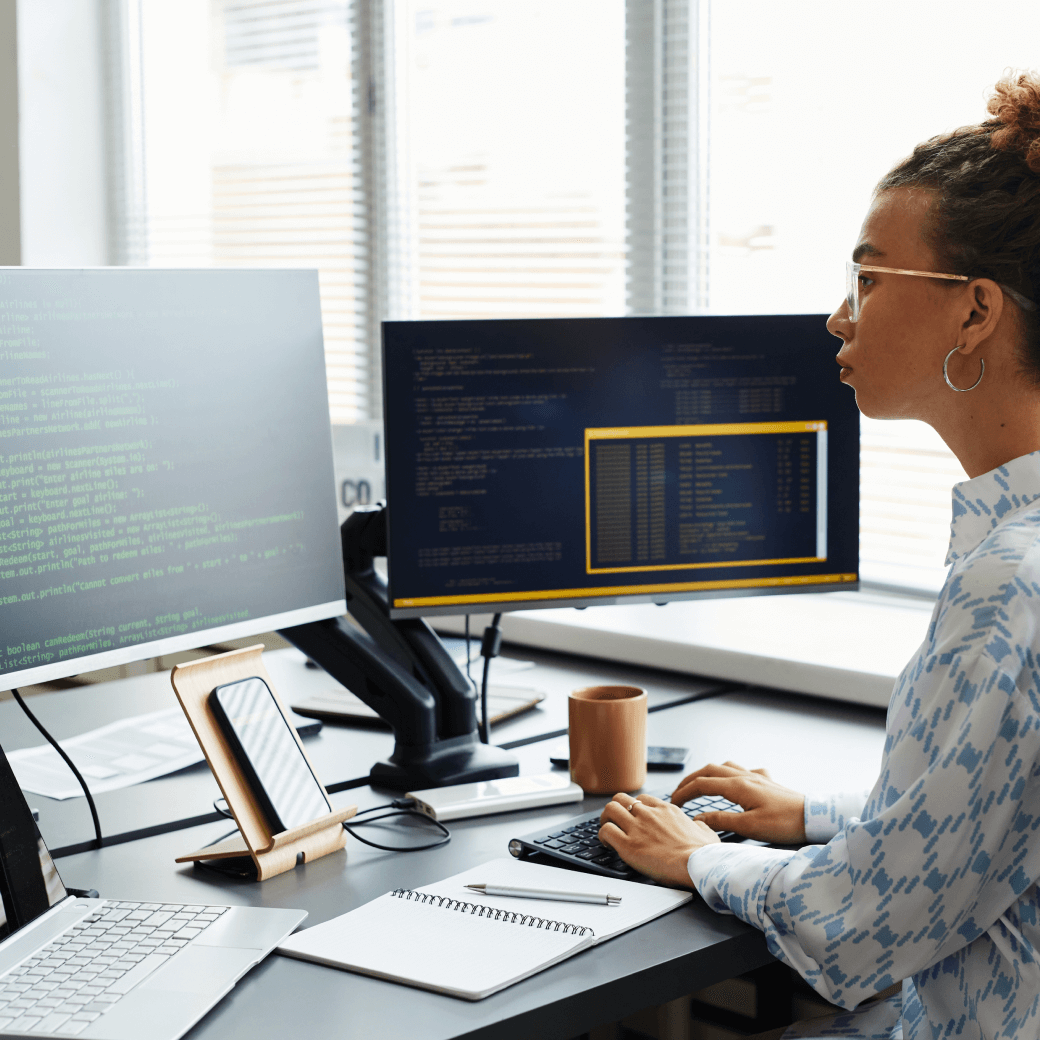

AI and data-driven decision-making: A case study of MyCFO

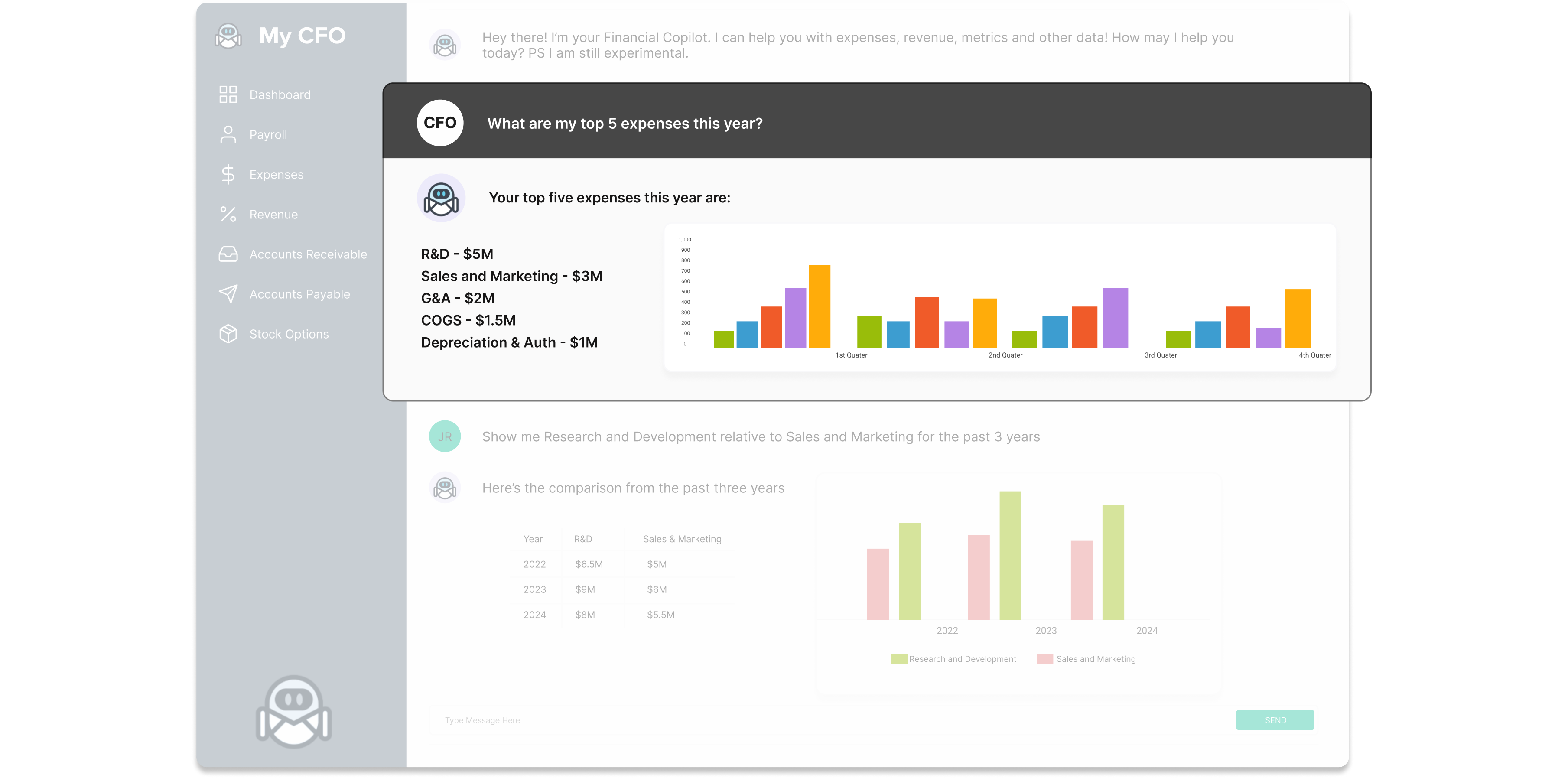

One of the most amazing uses of AI-driven data analytics in financial services is MyCFO; It is an AI-powered solution developed by 10Pearls and was designed to simplify decision-making for professionals in the financial services sector.

MyCFO is a smart virtual assistant and it is capable of extraction and analysis of data from various financial systems such as cash flow forecasting and expense management. It can also present insights in real-time.

This tool has significantly helped a leading fintech company to improve its financial management process by providing automated workflows and transaction-level details. MyCFO is capable of natural language processing, which allows finance teams to access information quickly.

Benefits of AI in financial services

AI allows for rapid scalability and speed

The sheer volume of data that AI can process at unprecedented speeds can allow financial institutions to scale their business rapidly without proportionally increasing their resources. The National Bureau of Economic Research has reported AI implementations across banks in the US has reduced processing time by 60% on average, resulting in faster client onboarding and response times.

AI-driven data and analytics increase compliance and improve security

The financial sector is heavily regulated and requires significant level of compliance. AI-driven solutions ensure that institutions can stay up to speed with regulatory changes by automating compliance checks and monitoring for suspicious activity.

According to Accenture, over 90% of US financial firms have now improved their compliance accuracy by using AI-powered tools, which has resulted in minimum regulatory breaches and penalties.

Informed investment and portfolio management

AI solutions can provide real-time analytics for market trends, which allow agile decision making for asset managers. AI-powered algorithmic trading makes use of predictive analytics to assess stock options and investment opportunities with higher precision as opposed to traditional methods.

The National Bureau of Economic Research has reported that AI implementation across banks in the US have reduced processing time by 60% on average, resulting in faster client onboarding and response times.

The future of AI in financial services

As the financial services sector grows digitally, AI’s role in cybersecurity will become indispensable. Now that cyberattacks are becoming more frequent and sophisticated, AI algorithms will become crucial in monitoring network traffic, responding to threats in real-time, and identifying network vulnerabilities.

Conclusion

AI-driven data and analytics have been transforming the financial services landscape around the world. From enhanced customer experiences and operational efficiencies to improved risk management and compliance, AI offers a multitude of benefits for financial institutions.

MyCFO solution developed by 10Pearls is a shining example of AI empowering professionals by simplifying financial management and enabling them to make data-driven decisions quickly and with greater accuracy.

If you’re looking to stay competitive, the adoption of AI in financial services is not just beneficial, it is essential. 10Pearls is at the forefront of this transformation as it continues to deliver value in an increasingly digital world.